Stop Senior Scams: How to spot – and avoid – fake jobs

By Jeremy Rodriguez

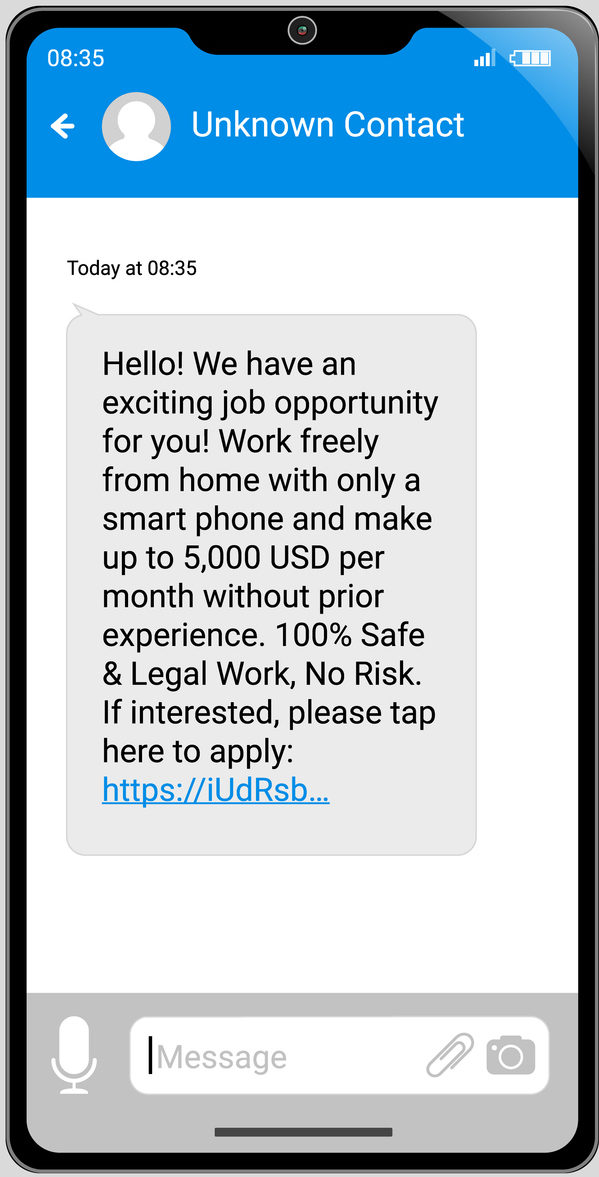

Getting a new job can be a godsend when you’re struggling to pay the bills, especially if it’s an easy job where you can work from home or perform simple tasks for a paycheck. However, these offers can be too good to be true at times, which is why it’s vital to remain vigilant.

The Federal Trade Commission provides several examples of job scams. These include:

- Work-from-home job scams. These jobs often come with flowery language such as “be your own boss” or “start your own business.” For example, a company may ship items to you and request that you reship them to another location overseas. You will get promised a check after working for a month, but the check never arrives.

- Nanny, caregiver, and virtual personal assistant job scams. Sometimes, you may receive messages from people who seem to be a part of your community. They’ll send you a check for your “services” in advance and instruct you to deposit part of the money for yourself and to send the rest of the money elsewhere. The check will then bounce, you’ll have to repay the full amount for the fake check, and the scammer will pocket the money you send them.

- Mystery shopper scams. Mystery shopping jobs are legitimate, but when a potential employer asks you to pay for “certifications” or to deposit a check and send money back, it’s a scam.

- Job placement service scams. Job placement services, such as temporary or staffing agencies are legitimate but if they ever ask you to pay a fee for their “services” to help you find a job, walk away.

- Government and postal jobs scams. Like the above scams, these employers will ask for a fee in exchange for securing you a job. Remember that applying for federal or postal jobs is always free.

Avoiding a job scam has been made much easier thanks to the internet. The Federal Trade Commission recommends searching the company online with words such as “scam” or “review” to see if other people have been scammed. Additionally, it is always best to assume that if a company asks you for money, it is a scam. In a recent interview with AARP, Hilary Donnell, the head of corporate social responsibility and public affairs for online security company Aura, said that if an employer asks you to switch from a job platform (e.g., LinkedIn) to another platform to talk about the opportunity, it could likely be a scam. Sometimes, the alternative platform can be encrypted to make tracing the scammer more difficult.

If you believe you have been the victim of a job scam, report it to ReportFraud.ftc.gov or to your state attorney general.

If you know an older adult in Philadelphia who may be experiencing financial exploitation, please contact PCA’s Older Adult Protective Services by calling the PCA Helpline at 215-765-9040. All calls are confidential.

Jeremy Rodriguez is a freelance journalist, blogger, editor and podcaster.